Preparing a bank reconciliation and journal entries

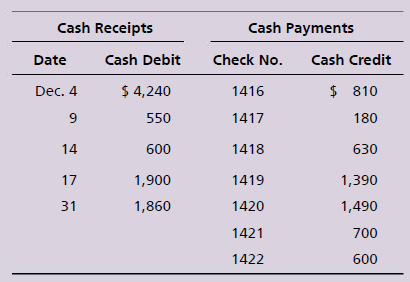

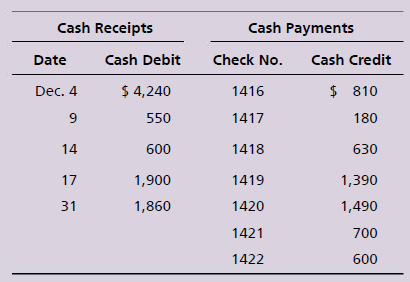

The December cash records of Davidson Insurance follow:

Davidson’s Cash account shows a balance of \(17,450 at December 31. On December

31, Davidson Insurance received the following bank statement:

Additional data for the bank reconciliation follow:

a. The EFT credit was a receipt of rent. The EFT debit was an insurance payment.

b. The NSF check was received from a customer.

c. The \)1,400 bank collection was for a note receivable.

d. The correct amount of check no. 1419, for rent expense, is \(1,930. Davidson’s

controller mistakenly recorded the check for \)1,390.

Requirements

1. Prepare the bank reconciliation of Davidson Insurance at December 31, 2018.

2. Journalize any required entries from the bank reconciliation.