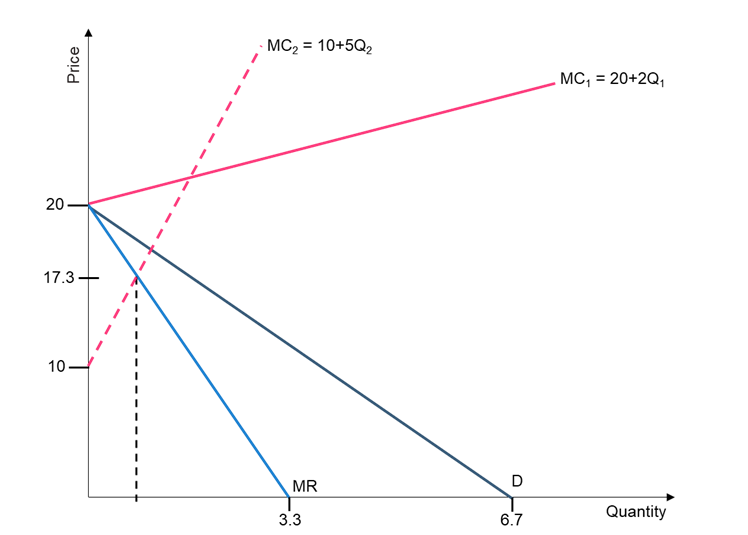

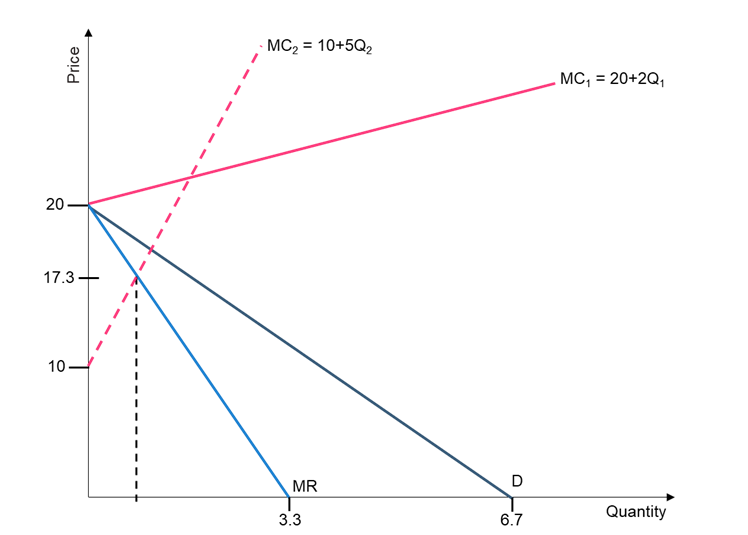

The following diagram contains the two plants' marginal cost curves, the product's demand curve, and the marginal revenue curve.

The diagram shows that the marginal cost curve of the first firm is not relevant to the computation of the market conditions because it is above the demand curve.

Thus, the demand curve will only contain the quantity of medicine produced by the second plant. You can write the demand function as P = 20 - 3Q2.

The marginal revenue function will have twice the slope of the inverse demand function. Thus, you can write it as MR = 20 - 6Q2.

You can equate the marginal cost of the second firm to the marginal revenue to find the profit-maximizing output as follows:

20 - 6Q2 = 10 +5Q2

11Q2 = 10

Q2 = 0.91

Thus, the second firm produces 0.91 units, and the first plant should produce 0 units.

You can substitute the quantity into the inverse demand function to obtain the profit-maximizing price as follows:

P = 20 - 3(0.91)

= 20 - 2.73

= $ 17.27

Thus, the first plant should not produce anything as the product should be made entirely in the second firm. The second plant should produce 0.91 units and sell them at $17.27 per unit.